![]() The intelligence platform for private equity

The intelligence platform for private equity

Redefining the Future of Private Equity Intelligence

Compound Intelligence

Kairos by Brownloop turns every deal and update into lasting institutional memory.

Unified Workflows

Purpose-built private equity software platform, Kairos by Brownloop unifies teams and accelerates processes from sourcing to LP reporting.

Intelligent Infrastructure

A secure, scalable private cloud that integrates your entire tech stack into one intelligent infrastructure.

Trusted Intelligence

Compound Intelligence

Kairos turns every deal and update into lasting institutional memory.

Unified Workflows

Purpose-built for PE, Kairos unifies teams and accelerates processes from sourcing to LP reporting.

Intelligent Infrastructure

A secure, scalable private cloud that integrates your entire tech stack into one intelligent infrastructure.

Trusted Intelligence

Domain Trained AI Agents for Every Private Equity Team

Purpose built intelligence platform for Private Equity teams. Investment teams or Finance, Investor Relations or Value Creation, Kairos is crafted for your team’s goals and context.

Accelerate From Teaser to Close

Move beyond surface-level screening with instant company mapping, AI-assisted deal sourcing, and automated diligence prep, turning weeks of manual work into hours.

Coordinate Diligence from One Workspace

Avoid toggling across systems and missing critical red flags with a unified view that learns from your workflows.

Generate IC Memos in Hours, Not Days

Connect Thesis to Value Creation

Track Every Initiative in Real Time

Eliminate silos and ensure accountability with a centralized dashboard that adapts as initiatives progress

Standardize KPI Reporting Across PortCos

Compare metrics with confidence, no matter the format or source, powered by AI that learns from every data stream.

Monitor ROI as It Happens

Spot underperformance early and intervene before value erodes, with AI continuously tuned to real-time signals.

Unlock Synergies Across the Portfolio

Identify shared spend patterns and drive smarter vendor decisions, with intelligence that compounds across companies.

Real-Time Initiative Intelligence

Track value creation initiatives across the portfolio from a single adaptive dashboard. Break down silos and maintain accountability with AI that is purpose-built for private equity.

KPI Reporting Without Friction

Standardize performance tracking across portfolio companies with harmonizes data from any source or format, enabling confident, apples-to-apples comparisons.

Live ROI Monitoring

Catch underperformance before it impacts returns. AI-driven monitoring continuously ingests real-time signals, giving teams the foresight to act before value erodes.

Portfolio-Wide Synergy Mapping

Accelerate NAV Reporting Cycles

Eliminate manual consolidation with automated milestone tracking intelligence that improves accuracy with every cycle.

Forecast Cash Flows with Confidence

Use dynamic models to plan calls, distributions, and expenses, powered by AI that learns from financial data trends.

Catch Fee Leakages Automatically

Reconcile fund transactions and accruals with precision (not spreadsheets) using agents trained to detect anomalies.

Simplify Compliance and Audit Readiness

Automate audit packs and meet ILPA standards without the scramble, with always-on AI tuned to compliance needs.

Accelerate NAV and Fund Reporting

Cut NAV and fund reporting cycles with automated consolidation and milestone tracking with accuracy at every run.

Forecast with Precision

Model calls, distributions, and expenses using AI that learns from historical and real-time financial data trends for sharper forecasting.

Catch Revenue and Fee Leakages

Automate reconciliation of fund transactions and accruals, with agents trained to detect anomalies and eliminate spreadsheet errors

Stay Audit and Compliance Ready

Generate ILPA-standard audit packs instantly with always-on AI tuned to compliance requirements, reducing last-minute fire drills.

What Sets Kairos by Brownloop Apart?

Instead of competing with legacy tools, we’re redefining what intelligence means for private equity.

Beyond the Traditional Tools

- Persistent intelligence, not static reports

- Compound knowledge, not point-in-time data

- Seamless workflows, not tool switching

- AI-native, not AI-patched

Built for Advantage

- Deep enterprise integration that locks in value

- Knowledge graph that gets smarter with every use

- Purpose-built for private equity, not generic BI

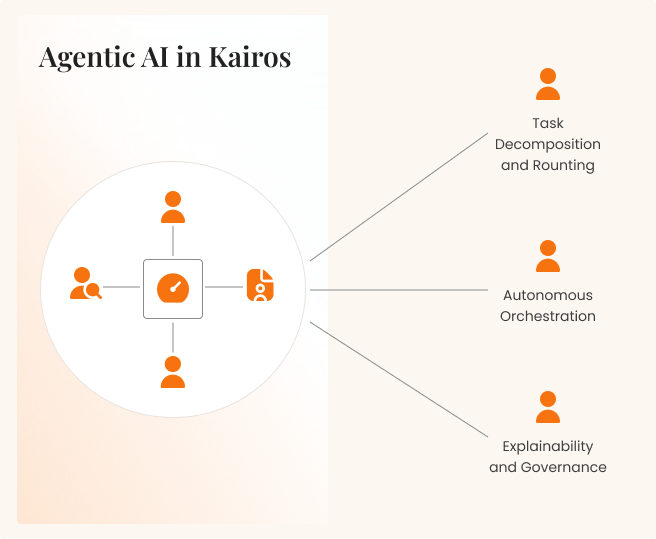

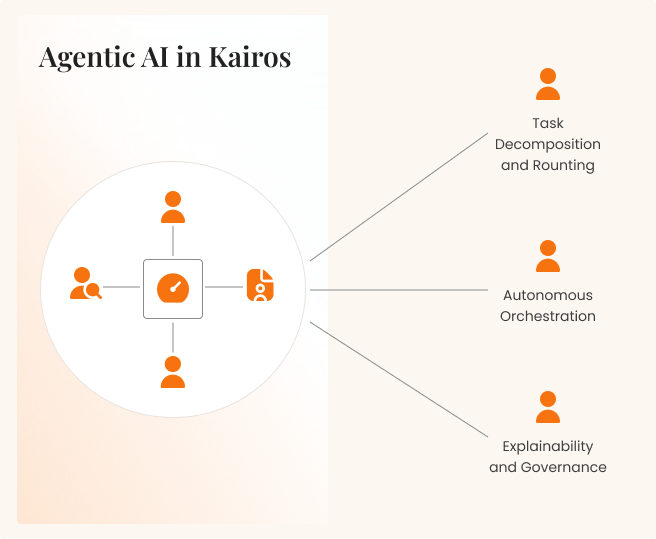

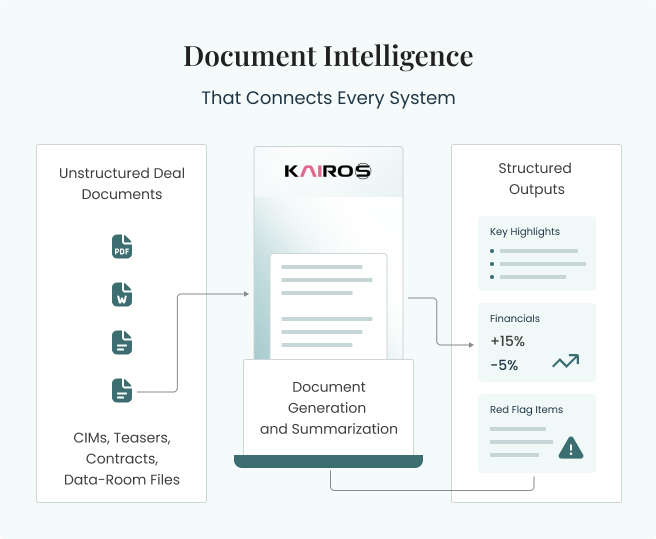

Agentic AI for Reimagining Your Workflows into Outcomes

Kairos by Brownloop comes with a suite of intelligent agents explicitly built for private equity workflows. Powered by our Agentic AI framework, these agents transform human-driven processes into autonomous and deeply integrated digital operations tuned for the full investment lifecycle. From generating IC memos, portfolio reports, and strategic analyses to forecasting cash flows, tracking vendor spend, and synthesizing diligence data, each agent acts like an expert on your team, delivering context-rich outputs with precision and scale.

Integrates seamlessly across PE processes

Automates IC and portfolio reporting

Tracks performance, market signals, and competitive dynamics in real time

Provides explainable audit trails

Learns and adapts continuously

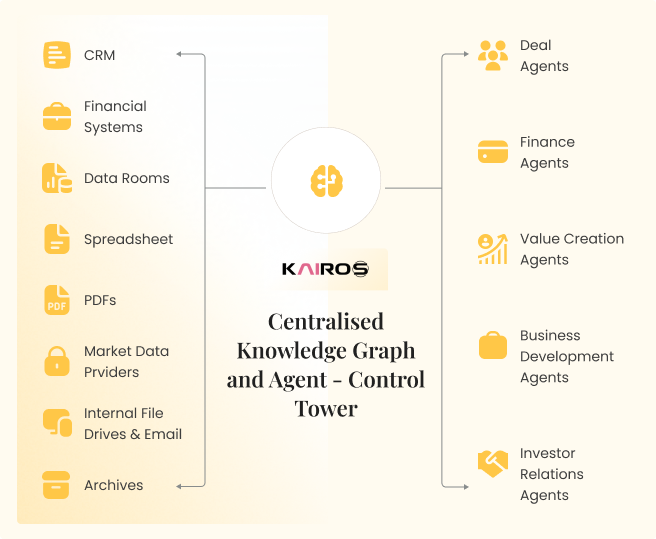

Knowledge Graphs to Compound Your Institutional Memory

At the core of Kairos by Brownloop is a dynamic knowledge graph purpose-built for private equity. Designed to unify structured system data with unstructured documents, it creates a living, compound knowledge architecture that connects companies, markets, investors, metrics, and deal structures. Unlike static tools, it continuously refreshes, compounds intelligence over time, and retains persistent memory so no insight is ever lost. By surfacing risks and opportunities, powering context-aware recommendations, it ensures more strategic decision-making.

Unifies structured and unstructured data

Connects companies, markets, and relationships

Compounds knowledge with persistent memory

Surfaces risks and opportunities in real time

Strengthens decision-making across workflows

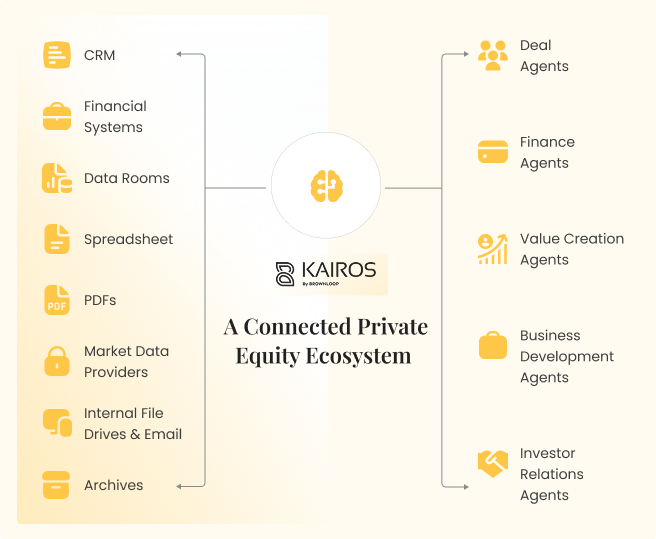

Scale with Enterprise Grade Infrastructure & Integration

Kairos by Brownloop transforms fragmented data into a unified, reliable foundation for private equity firms. Deployed in a secure private cloud, it integrates seamlessly with CRMs, VDRs, fund admin platforms, spreadsheets, and portfolio systems. Bi-directional data flows ensure accuracy and consistency, while agent-to-agent communication drives true workflow automation. By reconciling, standardizing, and syncing inputs in real time, Kairos by Brownloop eliminates silos, reduces manual effort, and delivers continuous intelligence across deals, portfolios, and investor interactions.

Private cloud deployment with enterprise-grade security

Seamless integration into existing PE tech stacks

Bi-directional data flow across systems

Agent-to-agent workflow automation

Real-time accuracy and consistency

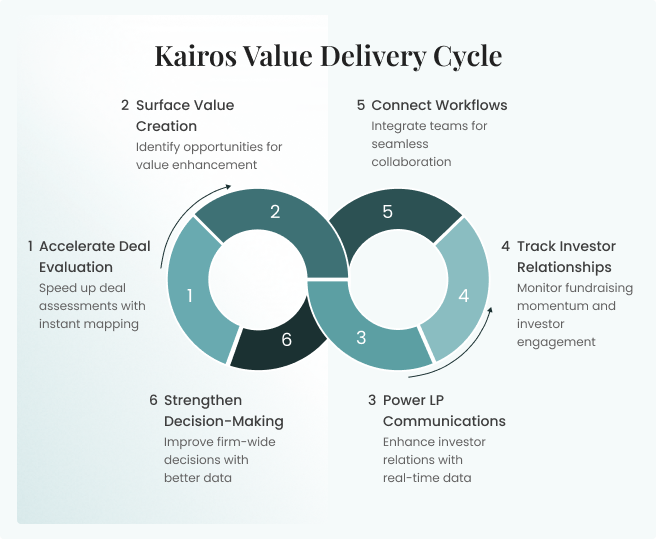

Experience Immediate Value Delivery Across Every PE Function

Kairos by Brownloop is designed to deliver tangible value from day one, empowering every function across the private equity lifecycle. Deal teams accelerate evaluations with instant mapping and automated diligence packs. Portfolio teams gain living company profiles that track value creation in real time. Investor Relations benefits from always-current LP intelligence and fundraising insights, while Middle Office workflows connect seamlessly to eliminate silos. The result: faster execution, stronger collaboration, and smarter decision-making across the firm.

Accelerates deal evaluation from teaser to close

Surfaces continuous value creation opportunities

Powers LP communications with real-time intelligence

Tracks investor relationships and fundraising momentum

Connects workflows across teams for seamless collaboration

Reduces friction and strengthens firm-wide decision-making

Agentic AI for Reimagining Your Workflows into Outcomes

Kairos by Brownloop comes with a suite of intelligent agents explicitly built for private equity workflows. Powered by our Agentic AI framework, these agents transform human-driven processes into autonomous and deeply integrated digital operations tuned for the full investment lifecycle. From generating IC memos, portfolio reports, and strategic analyses to forecasting cash flows, tracking vendor spend, and synthesizing diligence data, each agent acts like an expert on your team, delivering context-rich outputs with precision and scale.

Integrates seamlessly across PE processes

Automates IC and portfolio reporting

Tracks performance, market signals, and competitive dynamics in real time

Provides explainable audit trails

Learns and adapts continuously

Knowledge Graphs to Compound Your Institutional Memory

At the core of Kairos by Brownloop is a dynamic knowledge graph purpose-built for private equity. Designed to unify structured system data with unstructured documents, it creates a living, compound knowledge architecture that connects companies, markets, investors, metrics, and deal structures. Unlike static tools, it continuously refreshes, compounds intelligence over time, and retains persistent memory so no insight is ever lost. By surfacing risks and opportunities, powering context-aware recommendations, it ensures more strategic decision-making.

Unifies structured and unstructured data

Connects companies, markets, and relationships

Compounds knowledge with persistent memory

Surfaces risks and opportunities in real time

Strengthens decision-making across workflows

Scale with Enterprise Grade Infrastructure & Integration

Kairos by Brownloop transforms fragmented data into a unified, reliable foundation for private equity firms. Deployed in a secure private cloud, it integrates seamlessly with CRMs, VDRs, fund admin platforms, spreadsheets, and portfolio systems. Bi-directional data flows ensure accuracy and consistency, while agent-to-agent communication drives true workflow automation. By reconciling, standardizing, and syncing inputs in real time, Kairos eliminates silos, reduces manual effort, and delivers continuous intelligence across deals, portfolios, and investor interactions.

Private cloud deployment with enterprise-grade security

Seamless integration into existing PE tech stacks

Bi-directional data flow across systems

Agent-to-agent workflow automation

Real-time accuracy and consistency

Experience Immediate Value Delivery Across Every PE Function

Kairos by Brownloop is designed to deliver tangible value from day one, empowering every function across the private equity lifecycle. Deal teams accelerate evaluations with instant mapping and automated diligence packs. Portfolio teams gain living company profiles that track value creation in real time. Investor Relations benefits from always-current LP intelligence and fundraising insights, while Middle Office workflows connect seamlessly to eliminate silos. The result: faster execution, stronger collaboration, and smarter decision-making across the firm.

Accelerates deal evaluation from teaser to close

Surfaces continuous value creation opportunities

Powers LP communications with real-time intelligence

Tracks investor relationships and fundraising momentum

Connects workflows across teams for seamless collaboration

Reduces friction and strengthens firm-wide decision-making

Automation for a Competitive Edge

Transforming Operations at a Global Private Equity Firm with AI and Automation

Enhanced Data Intelligence

How a Top PE Firm Advanced its Investment Process with Automation and AI

Innovation with AI Automation

Enhancing Private Equity Spend Analytics for a PE Firm

Improved Accuracy and Quality

Enhanced Operational Efficiency

Future-Ready Private Equity Data Strategy Leveraging LLM, AI, and Process Automation

Drive Faster Decisions

Transforming Portfolio Risk Management for a Mid-Segment Private Equity Firm

Modernize Private Equity Workflows

Activate Intelligence for Your PE Teams