The private equity deal sourcing landscape has never been more competitive. Firms are under increasing pressure to source high-quality deals quickly and efficiently, as transaction pace accelerates and deal timelines compress. In this environment, deal teams must act faster, make better decisions, and ensure that their strategies align with the firm’s long-term investment objectives.

Unfortunately, traditional deal sourcing processes are often slow and inefficient. Deal teams spend significant time on manual tasks, such as analyzing Confidential Information Memorandums (CIMs), reviewing data from Virtual Data Rooms (VDRs), and conducting initial due diligence. These processes, while necessary, are not only time-consuming but also prone to human error, which can result in missed opportunities, inefficiencies, or suboptimal investment decisions.

This is where artificial intelligence (AI) comes in. As AI in private equity continues to advance, it presents private equity firms with the opportunity to revolutionize their AI-driven deal sourcing and management strategies. By automating data extraction, streamlining decision-making, and providing real-time insights, AI can significantly improve the speed and accuracy of the PE deal process. This playbook outlines how AI can help overcome the inefficiencies that slow down deal sourcing, offering a strategic approach to leveraging this transformative technology for better outcomes.

The deal lifecycle in private equity typically involves several stages, including sourcing, screening, due diligence, underwriting, and post-investment value creation. Inefficiencies in any of these stages can cause bottlenecks that slow down the entire process. Deal teams often face the challenge of sifting through vast amounts of data, coordinating across multiple stakeholders, and ensuring that each stage is completed thoroughly and efficiently.

Manual data processing, inconsistent diligence frameworks, and lack of visibility into ongoing portfolio performance are just a few examples of the inefficiencies that can hinder the deal process. These issues not only reduce deal velocity but can also result in poor decision-making or missed opportunities for value creation.

One of the most significant inefficiencies that deal teams face is the manual extraction of data from CIMs and VDRs. These documents contain critical information, such as financials, growth projections, and management structures, all of which are essential for evaluating a deal’s potential. However, extracting this data by hand is time-consuming and prone to error.

In a traditional deal sourcing process, analysts must read through hundreds of pages of CIMs, identify key data points, and input that information into spreadsheets or other systems. This can take hours or even days, and increases the risk of human error. Inaccurate data or missed information can lead to flawed investment decisions and costly mistakes.

AI-powered tools like CIM & Teaser Summarizers can automate the data extraction process. These tools use Natural Language Processing (NLP) to scan CIMs and VDRs, identify key data points, and extract relevant information in a fraction of the time it would take a human. This allows analysts to focus on analyzing the data rather than gathering it, improving overall deal velocity with AI.

Due diligence is a crucial part of the deal process, as it helps firms assess the risks and potential rewards of a given investment. However, many firms struggle with inconsistent diligence frameworks. Without standardized processes in place, each deal may be evaluated differently, leading to errors, inefficiencies, and missed opportunities.

For example, one deal team may place more emphasis on financial due diligence, while another may focus primarily on operational factors. This lack of consistency can result in incomplete or biased evaluations, making it difficult to compare deals on an equal footing.

AI tools can help create a more consistent and structured diligence process. By automating tasks like financial modeling, risk analysis, and competitor benchmarking, AI ensures that each deal is evaluated according to the same criteria. This standardization not only improves the accuracy of the analysis but also accelerates the PE diligence automation process.

After a deal is closed, private equity firms often struggle to track the performance of their portfolio companies and measure the success of value creation private equity initiatives. Whether it’s revenue growth, margin improvement, or cost optimization, having a clear view of the progress of these initiatives is essential for making timely adjustments and maximizing returns.

However, without the right tools, it can be difficult to track these efforts effectively. Teams often rely on spreadsheets, emails, and meetings to stay updated, which leads to fragmented information and delayed decision-making.

AI-powered platforms provide real-time visibility into portfolio performance. By automating data collection and providing instant updates on key performance indicators (KPIs), AI enables deal teams to monitor progress toward value creation private equity goals and make adjustments as needed. This improves the overall effectiveness of value-creation strategies and helps ensure that firms are on track to achieve their targeted returns.

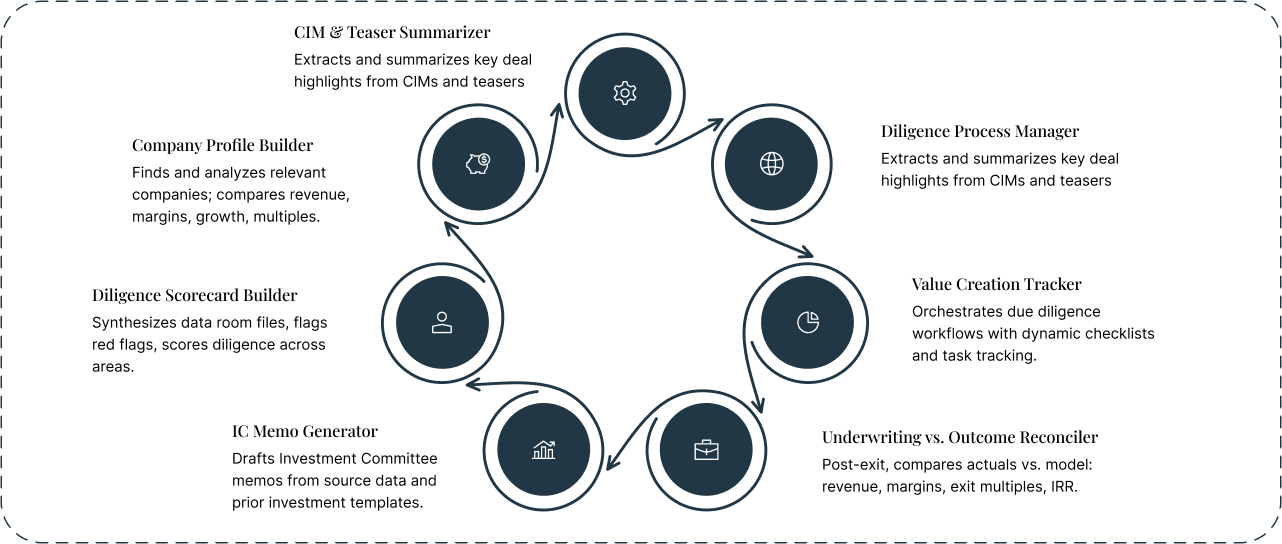

The deal funnel in private equity typically includes several stages: sourcing, screening, due diligence, underwriting, and post-investment value creation. AI can enhance each of these stages by automating tasks, standardizing processes, and providing real-time insights.

| Stage | Problem (Without AI) | AI Agent Capability (KAIROS) |

|---|---|---|

| Sourcing | Manual CIM scanning | CIM & Teaser Summarizer |

| Screening | Slow benchmarking & comp analysis | Company Profile Builder |

| Diligence | Unstructured data, no scorecards | Diligence Scorecard Builder |

| IC Memo & Approval | Time-intensive memo creation | IC Memo Generator |

| Underwriting | IRR & model misalignment post-close | Underwriting vs. Outcome Reconciler |

| Value Creation | Value levers not tracked | Value Creation Tracker |

| Diligence Management | Fragmented workflows & checklists | Diligence Process Manager |

Below is an overview of how AI can improve each stage of the deal funnel:

AI has the potential to transform each stage of the deal funnel. Whether it’s extracting data from CIMs, conducting due diligence, or generating investment committee memo (IC memos), AI tools can automate time-consuming tasks, reduce errors, and improve decision-making. By integrating AI into the deal process, private equity firms can increase deal velocity, enhance performance, and achieve better outcomes.

Sourcing typically involves reviewing CIMs to assess the quality of potential investments. However, manually scanning CIMs can take hours, and critical data can easily be missed. AI-powered CIM & Teaser Summarizers automate this process, scanning documents in minutes and extracting the most relevant information, enabling deal teams to make faster decisions and move on to the next step of the funnel.

Screening in private equity requires fast, accurate benchmarking against both internal metrics and external peers. Traditional methods often depend on fragmented public data and manual input, slowing down evaluations. Kairos’s Company Profile Builder draws from a combination of public sources, proprietary internal datasets, integrated CRM and file systems, and PE-relevant databases to build comprehensive, comparable profiles. This not only accelerates competitive analysis but also ensures consistency across deals.

During due diligence, firms often deal with unstructured data from a variety of sources. AI-powered tools like the Diligence Scorecard Builder can automate the process of organizing and structuring this data, ensuring that all relevant factors such as financials, legal considerations, and market conditions are evaluated consistently.

Creating Investment Committee (IC) memos can be a lengthy process. The IC Memo Generator automates the creation of these documents, pulling in relevant data and structuring it in a way that aligns with the firm’s investment thesis. This speeds up the approval process, allowing teams to move on to the next deal more quickly.

Misalignment between underwritten assumptions and actual performance remains a critical issue in private equity. Kairos’s Underwriting vs. Outcome Reconciler enhances underwriting analytics in PE by analyzing realized returns post exit and benchmarking them against original models. While its current strength lies in retrospective analysis, identifying trends across vintages, sectors, and deal structures, these insights feed forward into the underwriting process. Firms can refine future modeling assumptions based on systematically captured real-world outcomes. This loop fortifies underwriting discipline and deepens strategic conviction.

Tracking value creation efforts post-investment is critical for ensuring that the projected returns are realized. AI-powered platforms, like the Value Creation Tracker, provide real-time insights into key value levers, allowing deal teams to monitor progress and adjust strategies as needed.

Managing the diligence process across multiple stakeholders can be challenging. The Diligence Process Manager provides a centralized platform for organizing workflows, tracking tasks, and ensuring that all diligence steps are completed on time and to a high standard.

Successfully integrating AI into your deal sourcing requires a strategic approach. This framework outlines the key steps to incorporate AI into your PE workflows and maximize its impact on deal velocity, efficiency, and decision-making.

A strong data strategy is essential for AI success. Without clean, integrated data, even the best AI tools won’t deliver optimal results. Ensuring that your data is structured and accessible is crucial for maximizing the effectiveness of AI across your deal process.

With that foundation in mind, let’s look at the key steps for implementing AI effectively in your deal processes.

Before implementing AI, start by auditing your current deal sourcing process. Identify where bottlenecks occur, whether it’s in sourcing, screening, due diligence, or IC memo creation. By understanding where the inefficiencies lie, you can prioritize which AI tools to implement first.

A strong data strategy is essential for AI success. Centralize both structured and unstructured data sources into a unified platform, ensuring clean, accessible data for AI tools. Build data pipelines that enable seamless ingestion, labeling, and enrichment of deal-relevant inputs for AI consumption. This integration ensures that AI tools have high-quality, real-time data to drive accurate insights, improve decision-making, and enhance deal velocity.

Once you’ve audited your processes and established a data strategy, map each stage of your PE deal process to the appropriate AI agents. For example, use AI-powered CIM Summarizers at the sourcing stage and Diligence Scorecard Builders during due diligence. This ensures that AI is integrated seamlessly into your workflows.

Don’t try to implement AI across your entire deal process at once. Start with small-scale tools like automated IC memo creation or deal screening scorecards. Measure their impact; once positive results are evident, gradually expand AI integration to other stages of the deal funnel.

Ensure that your analysts are well-trained on integrating AI into PE workflows and using AI outputs effectively in their decision-making. This may include interpreting AI-generated reports, using AI-driven insights in investment committee discussions, or relying on AI-powered tools to track deal performance. Training is crucial to ensure that AI becomes an effective part of your team’s workflow.

To measure the effectiveness of AI tools, track key performance indicators (KPIs) such as time saved, deal velocity, and improvements in IRR. By quantifying the impact of AI, you can demonstrate its value to stakeholders and justify further investment in AI-powered tools.

Private equity workflows have long depended on spreadsheets, meetings, and fragmented platforms. But as market cycles tighten and competition intensifies, firms need more than just reporting. They need active intelligence.

One leading firm adopted Kairos to infuse its deal flow with Agentic AI capabilities. Instead of reactive reporting, their teams now operate with proactive insight, automated market scans, real-time risk signals, and on-demand analytics surfaced directly within investment workflows.

The result? Deal teams became faster and sharper. Whether identifying red flags in CIMs or comparing realized value creation to underwritten targets, Kairos provided insights when and where they mattered. It was not about replacing the human touch but enhancing it. Kairos equips analysts and partners alike with augmented decision-making that sets them apart in competitive auctions.

AI is revolutionizing the private equity deal lifecycle, from sourcing to underwriting and post-investment value creation. By automating routine tasks, improving accuracy, and providing real-time insights, AI enables deal teams to move faster and make smarter, data-driven decisions.

Request a demo today to see how AI can help your firm achieve better results.

Deal sourcing is the process of identifying and evaluating investment opportunities. AI enhances this process by automating tasks like CIM scanning and data extraction, allowing deal teams to focus on strategic decision-making.

AI improves efficiency by automating repetitive tasks, structuring unstructured data, and speeding up processes like benchmarking and due diligence, enabling faster decision-making.

AI technologies such as Natural Language Processing (NLP) for data extraction, Machine Learning (ML) for predictive analytics, and Automation for workflow management are commonly used in deal sourcing.

AI cannot predict success with certainty, but it can analyze historical data and market trends to offer insights that improve the accuracy of deal assessments.

AI tools are designed with strong security protocols to ensure compliance with data privacy regulations and protect sensitive investment information.