Build a Financial Operating System That Gets Smarter Every Quarter

The complete AI Experience Suite

Kairos FundOps Suite: From Manual Reconciliation to Real-Time Financial Control

The Kairos FundOps Suite replaces spreadsheets and disconnected systems with a real-time financial command center. Automate NAV tracking, valuation workflows, and LP reporting with AI solutions for finance teams by cutting close times while ensuring audit-ready accuracy. Free your team from reconciliation chaos and focus on high-value financial strategy.

Key Kairos Agents for Finance & FundOps Teams

NAV Calculation Agent

Valuation Intelligence Agent

Capital Call Agent

Distribution Agent

LP Reporting Agent

Audit Preparation Agent

Waterfall Modeling Agent

Reconciliation Agent

Tax Intelligence Agent

Regulatory Compliance Agent

End-to-End Financial Workflows

The Kairos FundOps Suite powers every stage of the fund operations lifecycle, from capital calls to audits, with continuous, intelligent automation. Eliminate error-prone spreadsheets and disconnected systems with AI solutions for finance teams, by unifying your financial data, calculations, and reporting into one real-time platform.

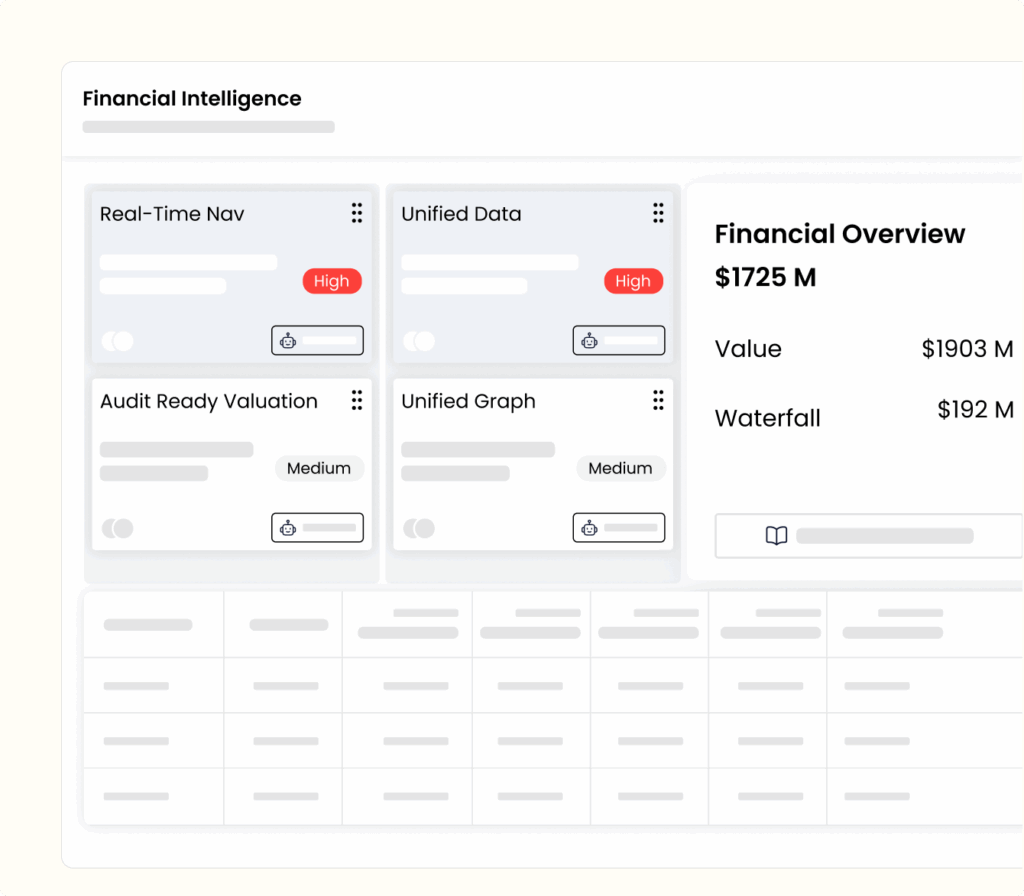

Continuous Financial Intelligence

Automated NAV & Waterfall Calculations: Auto-calculated with full transparency across fund structures.

Unified Financial Data Graph: Live integration from banks, portcos, fund admin, and models.

Audit-Ready Valuations: AI-suggested fair values based on portfolio performance and market comps.

Outcome: Close faster, eliminate reconciliation errors, and shift finance teams from firefighting to foresight.

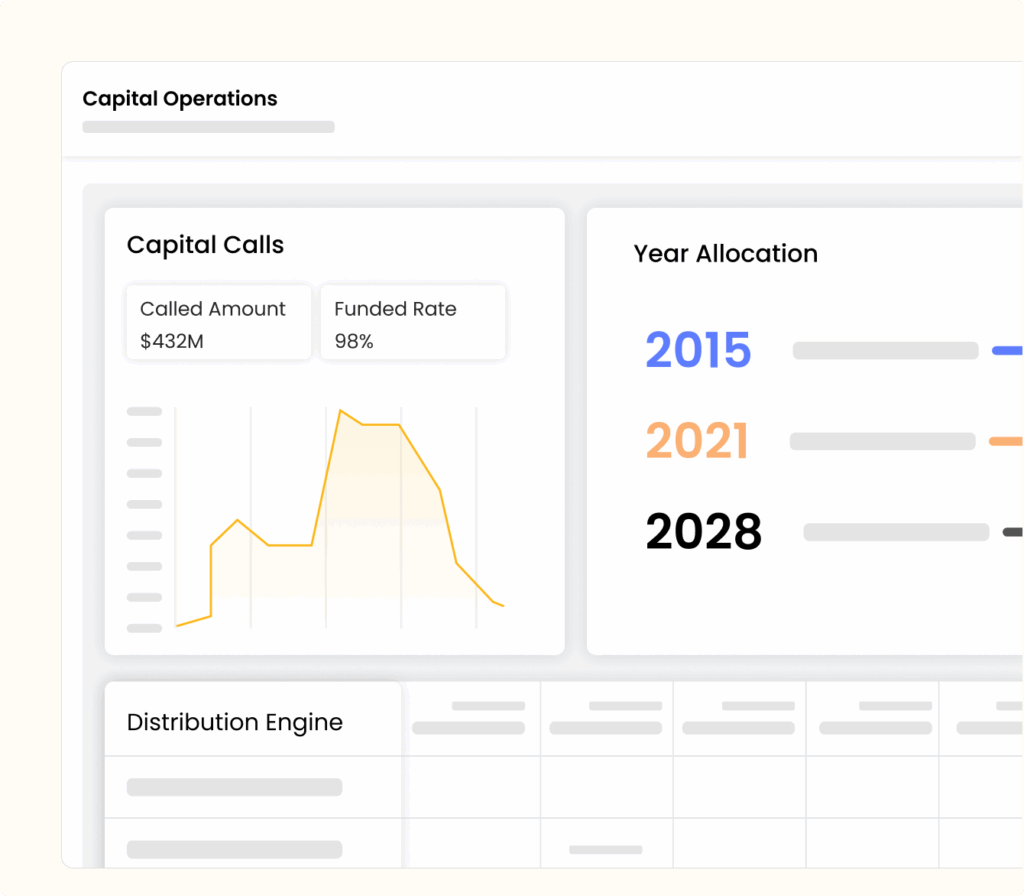

Automated Capital Operations Across Funds

From capital calls to distributions, automate the entire capital lifecycle with the precision, compliance, and speed of AI solutions for finance teams.

Capital Call Automation: Pro-rata calculations, side letter compliance, and wire tracking handled end-to-end.

Distribution Engine: Waterfall logic auto-applied, notices generated, and accounts updated without spreadsheets.

Multi-Fund & FX Support: Seamlessly handles vintage tracking, fund parity, expense allocation, and currency impacts.

Outcome: Zero-error capital movement with complete traceability, no matter the complexity.

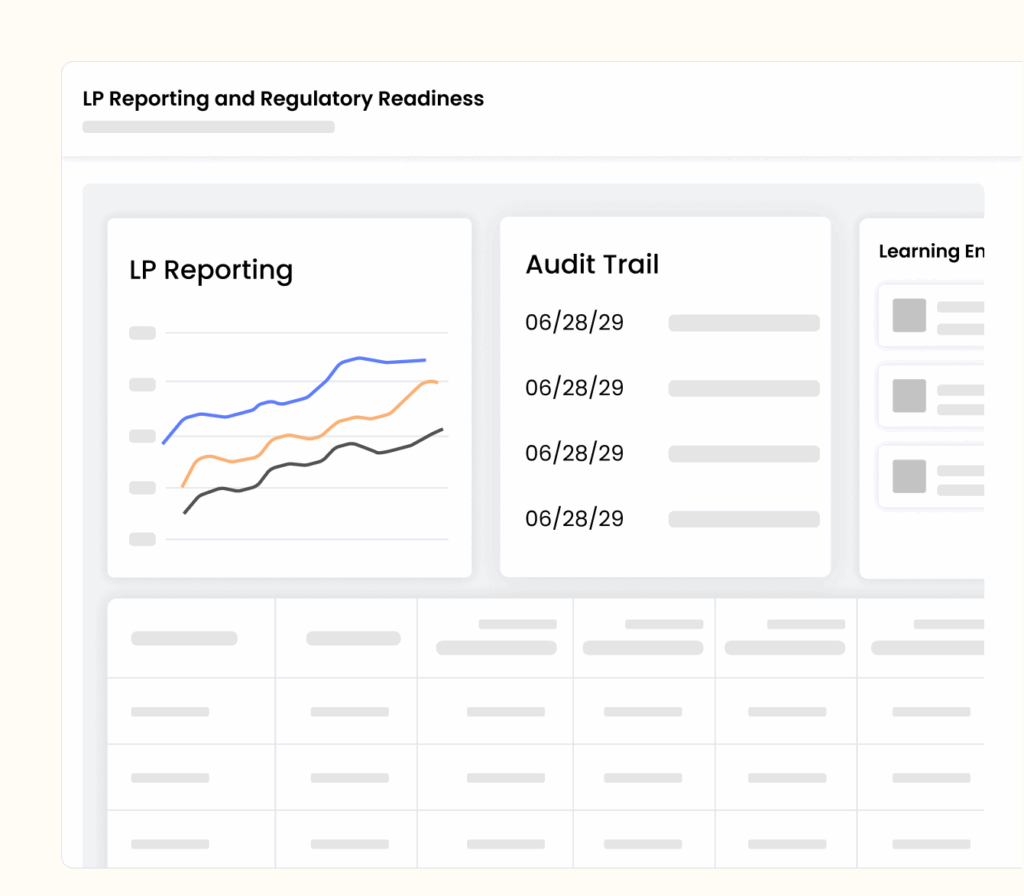

Always-On LP Reporting and Regulatory Readiness

Kairos continuously prepares audit workpapers and LP reports, eliminating quarter-end chaos and ensuring regulatory compliance by default.

LP Reporting Automation: Real-time generation of statements, fee breakdowns, and capital summaries.

Audit & Tax Intelligence: Self-updating audit trails, K-1 generation, and pre-populated filings like Form PF.

Learning Engine: Institutional memory compounds over time, preserving valuation logic and capital account rationale.

Outcome: Fund finance teams deliver accuracy, speed, and confidence—every quarter, every audit, every fund cycle.

The Kairos FundOps Suite Differentiator

Legacy systems record transactions, while Kairos’ AI solutions for finance teams orchestrates intelligence. Automate valuations, NAVs, waterfalls, and LP reporting, transforming your finance team from manual processors into real-time stewards of financial precision.

Without Kairos

- NAVs and valuations update only at quarter-end, causing delays.

- Valuation models rely on manual inputs and are error prone.

- Capital calls and distributions are calculated manually, risking errors.

- LP reports are stitched together from multiple systems.

- Audit prep is a scramble of backfilled documents.

- Institutional knowledge is lost in spreadsheets and staff turnover.

With Kairos FundOps Suite

- NAVs and valuations refresh continuously through a knowledge graph.

- AI updates valuation models using transactions, and PortCo data.

- Waterfall-driven capital activity is auto-calculated and auditable.

- LP reports generate instantly, eliminating weeks of manual collation.

- Audit documentation is continuous and ready before quarter-end.

- Financial intelligence compounds over time, surviving team transitions.

Tech Integration Made Simple

Tailored to Your Finance & Operations Team’s Workflows

From capital calls to compliance, Kairos is customized to your fund structures, reporting standards, and operational cadence.

While the Kairos FundOps Suite comes ready to deploy, Brownloop’s consulting team ensures it fits your exact needs, from waterfall logic and valuation models to reporting formats and audit workflows. We design precision around your process, not the other way around.

Customer success stories

Explore Our Latest Publications

Revolutionizing Investment Committee Visibility with Kairos by Brownloop

A global private equity firm with over $100 billion in assets under management (AUM) faced growing challenges in managing its Investment Committee (IC) processes.

Accelerating DDQ Responses by 78% for a Global Mid-Market Firm

Brownloop’s consulting standardized siloed workflows and data, enabling AI to cut DDQ response time by 78% and accelerate fundraising.

Revolutionizing Private Equity Deals Through CIM Automation

How a Top Private Equity Firm Advanced its Investment Process with Automation and AI

In the competitive private equity landscape, speed and precision are paramount. Manual Investment Committee (IC) memo preparation can be slow, inconsistent, and a significant bottleneck to high-value opportunities.

Enterprise-Grade Security and Compliance

Kairos is built to meet the highest standards of financial data security, privacy, and regulatory compliance. Role-based access, audit logs, private deployments, and data lineage tracking ensure every NAV, valuation, and LP record is protected, traceable, and audit-ready, without slowing execution.

SOC2 I

SOC2 II

Encrypted in transit

and at rest

No training on

user data

Fast to Deploy and Built to Scale

Discovery & Pilot

Deploy NAV and Valuation Agents. Automate quarter-close prep and eliminate manual reconciliation across key funds.

Expansion & Optimization

Activate LP Reporting, Capital Call, and Distribution Agents. Reduce reporting cycles and improve data accuracy by over 30%.

Institutionalization

Connect Kairos across deal, portfolio, and IR systems—building a compounding financial intelligence layer across all fund vehicles.

Time to ROI

Most finance teams see efficiency and audit-readiness gains within 60 days, achieving firm-wide consistency within one quarter.

Move From Manual Close Cycles to Continuous Financial Intelligence