Empower Deal Teams to Automate the Deal Workflow with AI Solutions for Intelligent Collaboration

The Kairos Deal 360 Experience Suite turns manual workflows into automated intelligence by unifying data, decisions, and execution across the private equity deal lifecycle.

The complete AI Experience Suite

Kairos Deal 360: The Intelligence Suite Accelerating Capital Deployment

Kairos Deal 360 is Brownloop’s integrated hub for deal team intelligence that transforms how private equity teams analyze, evaluate, and execute investments. As a part of our AI solutions for private equity deal teams, it unifies fragmented deal data into a cohesive intelligence system that enables deal teams to move from teaser to Investment Committee approval in days, not weeks, while maintaining strategic depth and precision.

Key Kairos Agents for Deal Teams

AI-powered agents handle high-value deal tasks while keeping your team in full control.

CIM & Teaser Summarizer

Company Profile Builder

Diligence Scorecard Builder

IC Memo Generator

Underwriting vs. Outcome Reconciler

Value Creation Tracker

Diligence Process Manager

See how every specialized AI agent works together to deliver end-to-end intelligence for modern private equity deal teams.

End-to-End Deal Workflow

Kairos Deal 360 integrates sourcing, evaluation, diligence, approvals, and post-close transitions into a unified workspace. The result is a single, connected, intelligent ecosystem that ensures speed, precision, and compliance across every transaction.

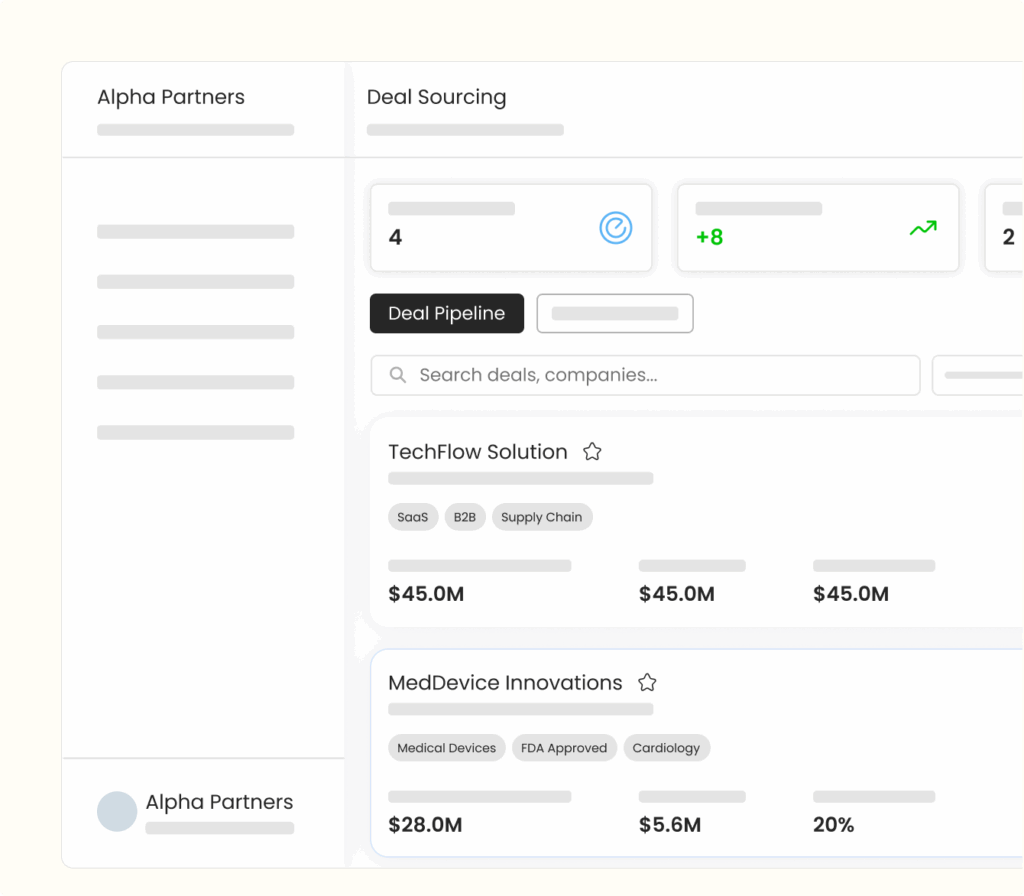

Unified Deal Sourcing in One Dashboard

Consolidate, analyze, and prioritize deals across every source with integrated AI solutions for private equity deal teams.

Central Deal Dashboard: Tabular interface aggregates opportunities from banks, databases, and proprietary sources.

Instant AI Summaries: AI generates one-page insights on company profiles, sector trends, and key signals.

Deal Prioritization: Flag and focus on high-fit deals aligned to your investment criteria

Integrated Analytics: Identify patterns, benchmarks, and sector dynamics with real-time visual dashboards.

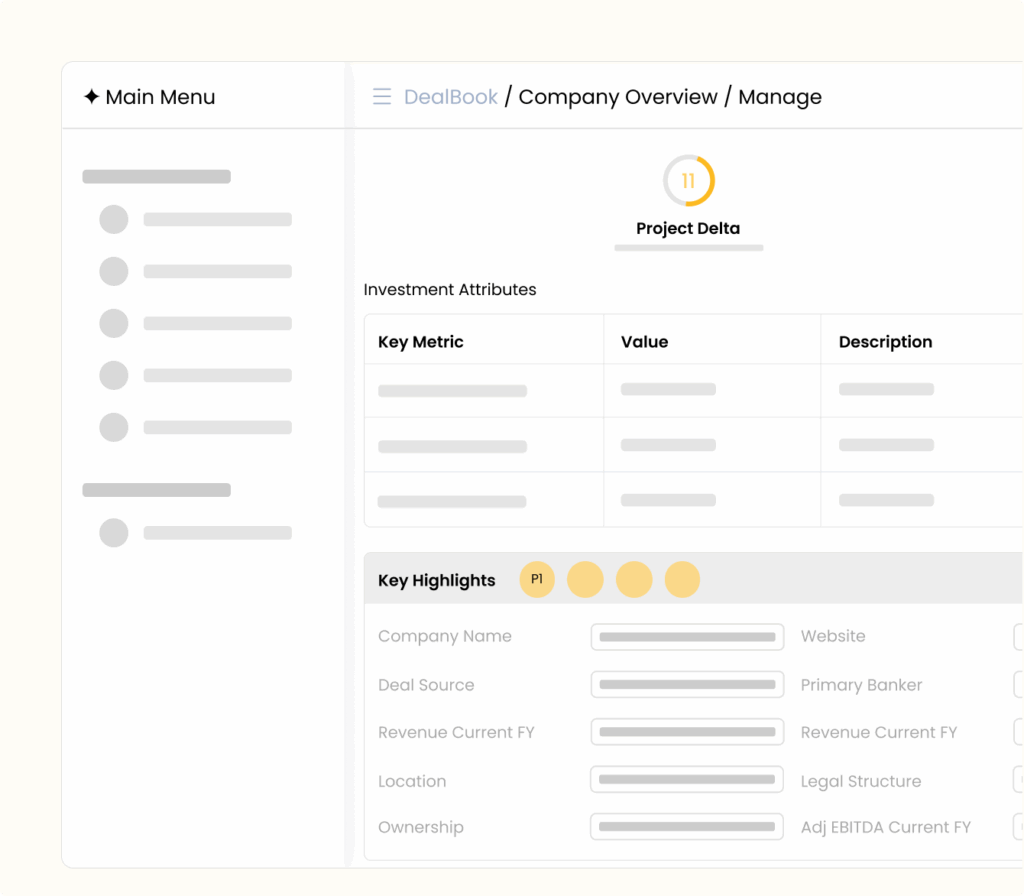

AI-Driven CIM Analysis at Scale

Streamline deal evaluation with automated extraction, benchmarking, and red flag detection.

Automated Data Extraction: Automatically extract key metrics from CIMs, minimizing manual effort and errors.

Customized Analytics Template: Apply sector-specific formats to uncover strategic insights faster.

Deal Benchmarking: Compare new targets against past deals and internal standards effortlessly.

Risk Flagging: Detect red flags and inconsistencies early to de-risk evaluations proactively.

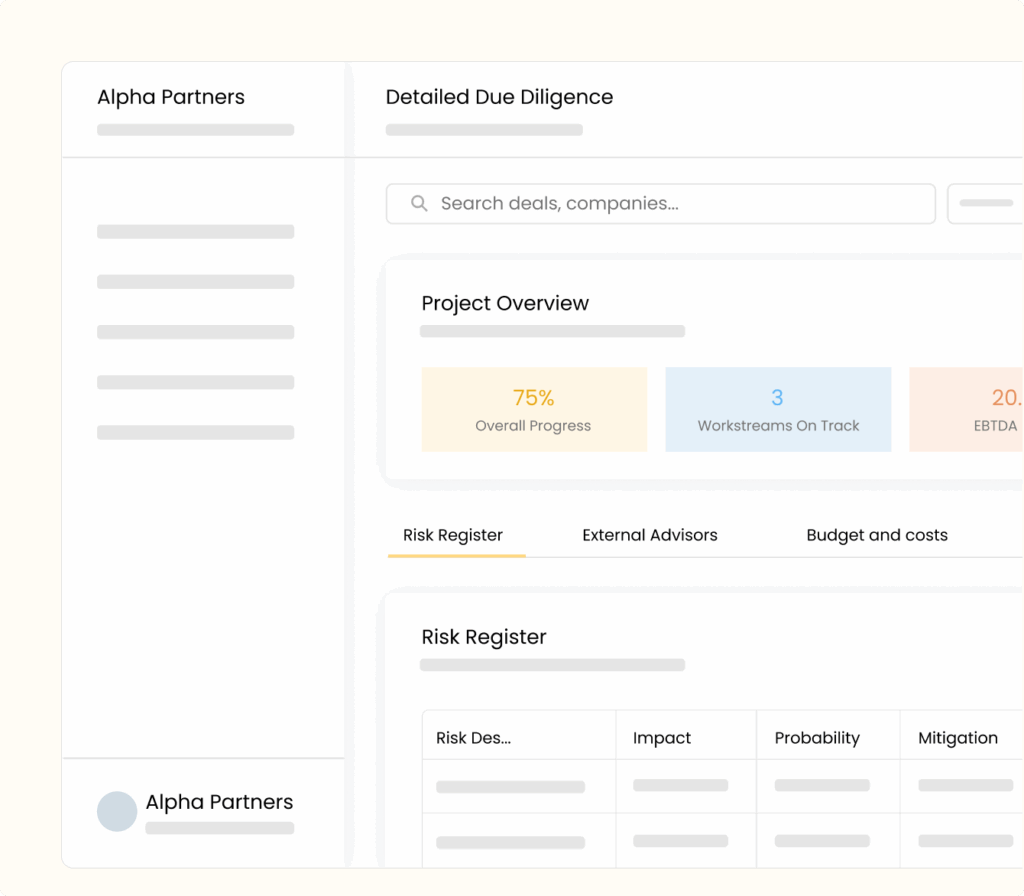

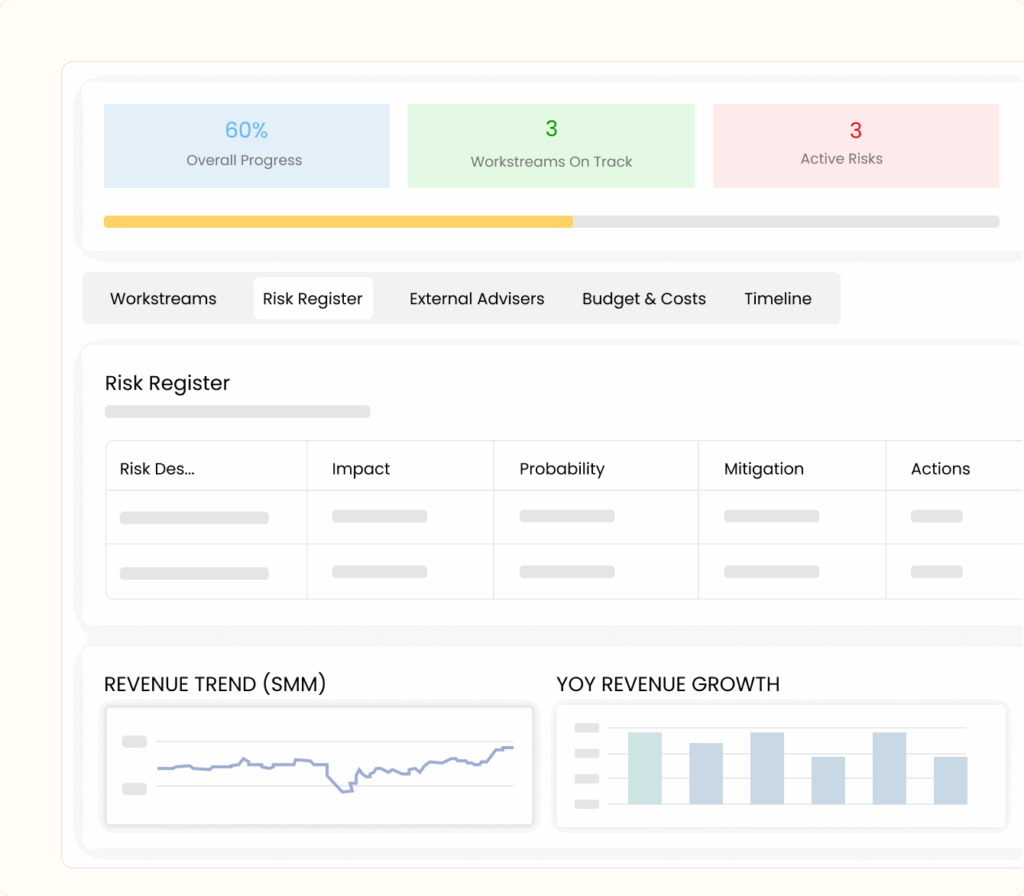

Streamlined Due Diligence Management

Orchestrate diligence with real-time visibility, AI insights, and seamless collaboration.

Cross-Functional Workstreams: Track status, ownership, and risk across commercial, legal, and more.

Discrepancy Detection: AI flags mismatches between CIMs and financial statements automatically.

Financial Snapshot: Instantly view revenue, margins, and FCF across deals for fast financial health checks.

Advanced Dashboards: Monitor diligence progress, risk areas, and budget alignment in one visual hub.

AI-Powered Investment Memo Generation

Speed up IC approvals with smart memos, feedback tracking, and decision workflows.

Instant Memo Creation: Generate concise, data-rich memos that highlight critical deal insights.

Feedback Management: Systematically capture and resolve IC comments for transparent approvals.

Integrated Voting Module: Enable quick, auditable voting decisions—approve, postpone, or reject with ease.

Seamless Deal Closure and Handoff

Close with confidence using structured workflows and automated LP-ready outputs.

Closing Checklist: Ensure no steps are missed with a comprehensive, task-driven workflow.

Approval Tracking: Centralize IC and legal sign-offs for final accountability and audit readiness.

Portfolio Operations Handoff: Auto-generate detailed transition materials for smooth post-close integration.

LP-Focused Summaries: Create AI-generated deal briefs tailored for investor communication.

The Kairos Deal 360 Differentiation

Without Kairos

- Data is spread across CRMs, spreadsheets, and VDRs with no single source of truth.

- Analysts spend hours extracting and comparing data from CIMs and financials.

- Investment memos and decks take days to compile and quickly go out of date.

- Insights arrive late, limiting agility and confidence in investment calls.

- Cross-functional teams rely on emails and offline trackers, slowing approvals.

- Valuable deal learnings are trapped in files and forgotten between transactions.

With Kairos Deal 360

- One environment connecting sourcing, diligence, IC prep, and closing.

- Automated CIM analysis, red-flag detection, and benchmarking in real time.

- Generate interactive memos and decks in minutes, updated dynamically.

- Data-driven recommendations and risk scoring guide faster, smarter action.

- All teams and stakeholders aligned through integrated, real-time workflows.

- Institutional knowledge compounds over time as Kairos learns from every deal, memo, and IC comment.

Integrate Seamlessly with Your Deal Ecosystem

Tailored to Your Deal Team’s Workflow

Personalized agent behavior to match your deal process.

Kairos Deal 360 is designed for flexibility. While it delivers plug-and-play intelligence across core deal workflows, our consulting services tailor and extend the platform to fit your firm’s unique challenges, specialized processes, and strategic transformation goals.

Explore Our Latest Publications

Revolutionizing Investment Committee Visibility with Kairos by Brownloop

A global private equity firm with over $100 billion in assets under management (AUM) faced growing challenges in managing its Investment Committee (IC) processes.

Accelerating DDQ Responses by 78% for a Global Mid-Market Firm

Brownloop’s consulting standardized siloed workflows and data, enabling AI to cut DDQ response time by 78% and accelerate fundraising.

Revolutionizing Private Equity Deals Through CIM Automation

How a Top Private Equity Firm Advanced its Investment Process with Automation and AI

In the competitive private equity landscape, speed and precision are paramount. Manual Investment Committee (IC) memo preparation can be slow, inconsistent, and a significant bottleneck to high-value opportunities.

Enterprise-Grade Security and Compliance

Kairos is designed for the rigorous security and compliance standards of private equity. Every layer ensures your confidential information remains protected, compliant, and auditable, without compromising agility or collaboration.

SOC2 I

SOC2 II

Encrypted in transit

and at rest

No training on

user data

Fast to Deploy and Built to Scale

Our implementation model ensures you see measurable value in weeks, not months, supported by hands-on onboarding, team enablement, and continuous optimization. Our AI solutions for private equity deal teams are engineered for rapid, low-friction deployment within private equity environments.

Rapid Integration

Plug into CRMs, VDRs, fund admins, and data providers without disrupting ongoing deals.

Collaborative Onboarding

Performance Ramp-Up

Within 45 days, teams begin experiencing measurable productivity and accuracy gains.

Sustained Partnership

Reimagine Deal Workflows with the Power of Compound Intelligence