The Connected Private Equity Experience, redefining analytics, insights and decision support for PE firms

Kairos empowers PE teams to uncover critical insights faster, streamline the due diligence process, and identify value creation opportunities that drive long-term growth.

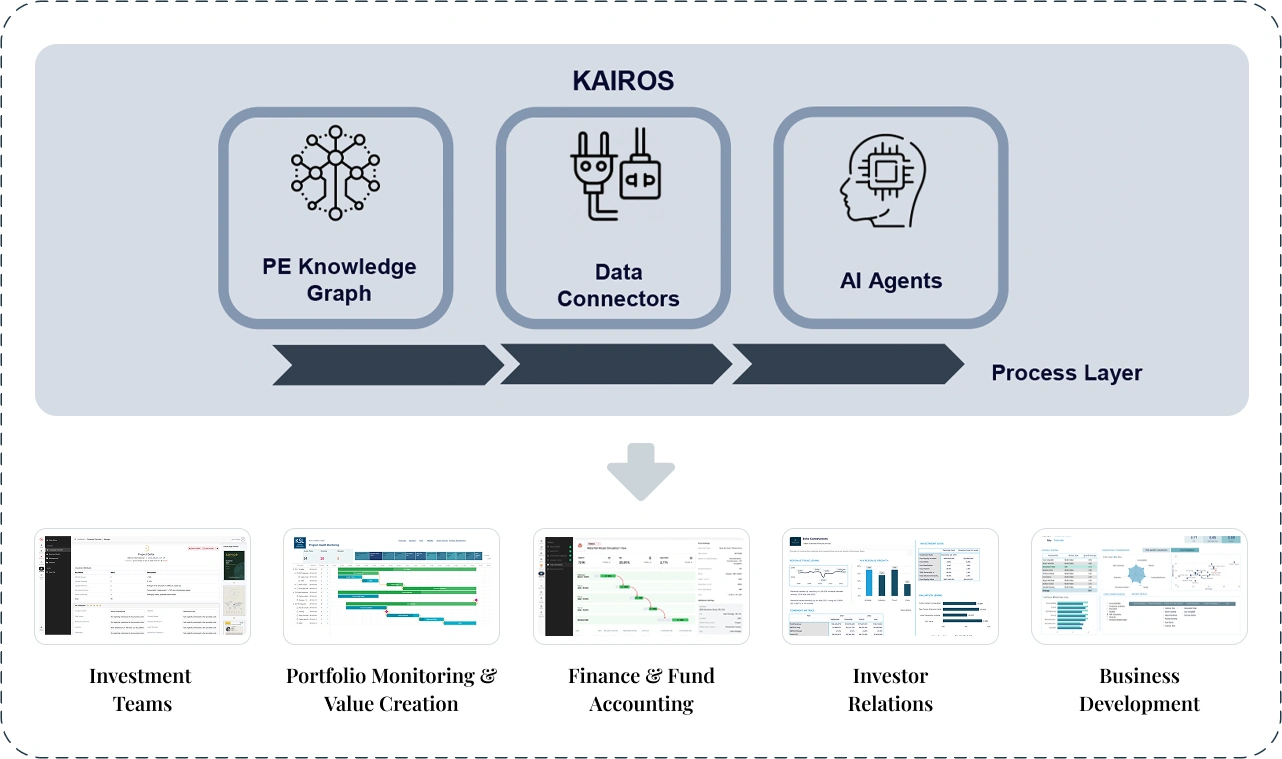

Kairos harnesses the combined strengths of Gen AI, Agentic AI, and Knowledge Graphs to fundamentally transform the way Private Equity professionals work.

With a trusted, data-first foundation, Kairos simplifies complex analysis, enables smarter decision-making, and enhances investor experiences by providing clear, actionable insights – when and where they’re needed most.

Purpose built for Private Equity, Kairos revolutionizes how PE professionals uncover insights, streamline due diligence, accelerate value creation and improve investor experiences.

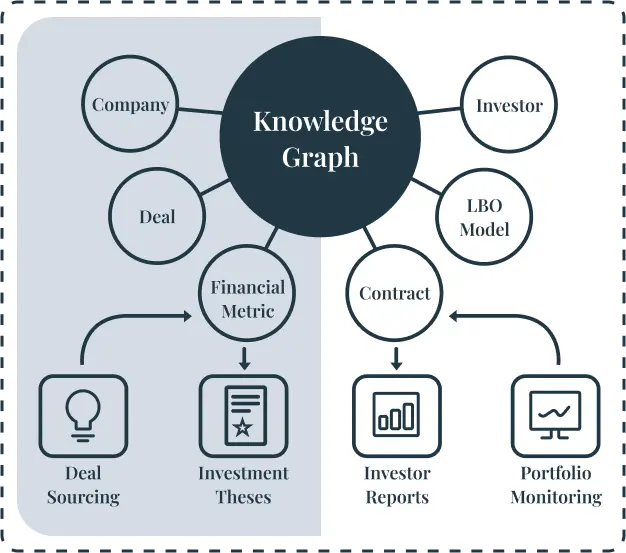

Over 800 connected entity types and relationships

Trained specifically for the context of Deal Sourcing, Investment Theses, LBO models, Investor Reports and Portfolio Monitoring

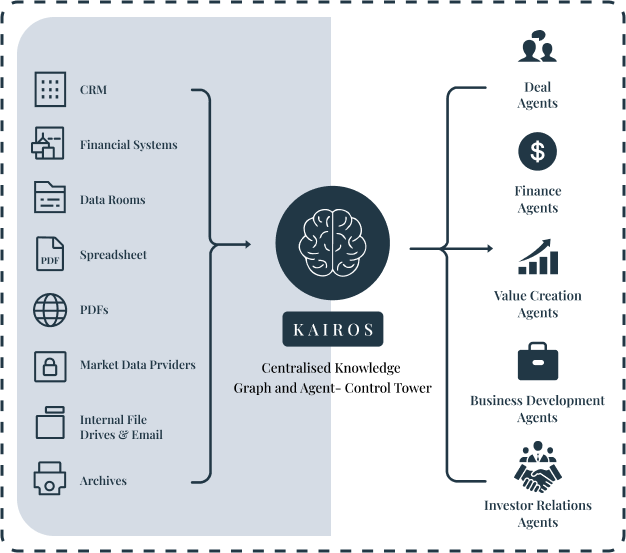

Specialized agents operate in concert through a central Control Tower

Context-aware routing between Deal Execution agents, Portfolio Optimization and IR agents

Connect seamlessly enterprise systems, third-party data feeds & files

Support for private deployments

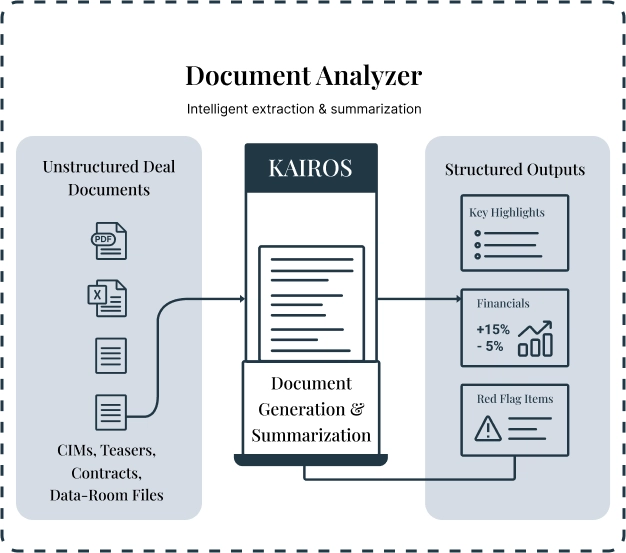

Extracts and summarizes key deal highlights from CIMs and teasers

Finds and analyzes relevant companies; compares revenue, margins, growth, multiples.

Synthesizes data room files, flags red flags, scores diligence across areas.

Drafts Investment Committee memos from source data and prior investment templates.

Post-exit, compares actuals vs. model: revenue, margins, exit multiples, IRR.

Maps value-creation levers at underwriting and tracks realization vs. plan.

Orchestrates due diligence workflows with dynamic checklists and task tracking.

Extracts and chronologically organizes financials from Excel, PDFs,and slides.

Monitors market developments, regulatory changes, and key personnel signals.

Surfaces high-spend areas, benchmarked against peers, to identify cost-saving opportunitiess.

Parses contract terms, renewal triggers, and obligations; flags risks and overlaps.

Monitors execution status, logs achieved milestones, flags delays vs. roadmap

Conversational interface to query all portco data— financials, ops, contracts, etc.

Auto-writes narratives on portco performance using financials and qualitative inputs.

Tracks deliverables, sends reminders, and flags overdue updates from portcos

Creates and updates offering memorandums using structured firm data.

Extracts key points and actionable insights from earnings calls and transcripts.

Generates LP-specific pitchbooks aligned to tone, format, and strategy.

Delivers timely, accurate LP reports aligned with ILPA and firm standards.

Auto-completes questionnaires using past responses, flags stale or missing data.

Drafts announcements and speaking points aligned to firm positioning.

Crafts timely, personalized replies to LP queries using internal knowledge.

Aggregates peer data, highlights valuation trends, and flags outliers by sector.

Combines valuation outputs with market data and firm guidelines into narratives.

Synthesizes data room files, flags red flags, scores diligence across areas.

Flags compliance violations and surfaces supporting evidence for every transaction.

Matches capital calls, bank feeds, and accounting entries for variance detection

Proposes legal entity structures from historical patterns and investment type.

Builds and refines cash flow models based on activity and trends.

Monitors NAV preparation milestones and delivery deadlines across funds.

Conversational interface to query fund-level and transaction data in real time.

Scans proprietary, public, and third-party sources to identify qualified targets.

Drafts highly tailored emails and materials using company signals and CRM history.

Tracks sourced opportunities through funnel stages, flags dropoff patterns and time lags.

Tracks firm’s brand mentions, panel appearances, and content in key sectors

Surfaces past touchpoints with targets: emails, meetings, deal notes, coinvests.

Extracts key insights, follow-ups, and sentiment from BD and target company calls.

Beyond Generative and Agentic AI, Kairos brings PE-native intelligence, seamless integration, and enterprise-grade security, all designed around the business user

Over 800 connected entity types and relationships Trained specifically for the context of Deal Sourcing, Investment Theses, LBO models, Investor Reports and Portfolio Monitoring

Pre-packaged AI agents for specified use cases like Deal sourcing, IC memo generation, Portfolio data collection and monitoring & Investor servicing

Kairos supports private deployments ensuring all private data and customer agent training never leaves within client’s infrastructure

Manual editing, review, and approval workflows ensure accuracy and compliance. Maker-checker capabilities maintain operational rigor

Redefining analytics, insights and decision support for Private Equity

From initial opportunity discovery to final execution, Kairos supports every stage of the PE lifecycle. With Kairos, PE firms gain clarity, speed, & confidence from day one to exit.

Surface key insights from complex datasets and external sources (portfolio financials, news, and market data included)

Automatically match, verify, and cleanse data points across diverse sources, reducing manual effort

AI agents automatically process and harmonize data from documents and systems

Instantly draft investment memos and reports, while still allowing human experts to refine and approve

At the heart of Kairos lies a domain-specific knowledge graph meticulously designed for private equity workflows. It connects over 800 entity types, such as companies, deals, LBO models, investors, financial metrics, contracts — and maps their interrelationships. This powerful structure underpins features like deal sourcing, investment theses, LBO modelling, investor reports, and portfolio monitoring. Built to harmonize both structured system data and unstructured inputs (e.g., CIMs, teasers, transcripts), it enables comprehensive situational awareness across the investment lifecycle.

For private equity teams, the Knowledge Graph acts as an intelligent fabric that breaks data silos and accelerates insight generation. Instead of spending hours manually stitching together information, deal teams, for example, can instantly navigate relationships across target companies, comparable transactions, portfolio companies, and sector trends. This dramatically improves due diligence speed, surfaces hidden risks, highlights cross-portfolio synergies, and identifies new investment opportunities.

As market conditions shift, the graph continuously updates and adapts, ensuring investment teams always have the most context-rich, actionable intelligence at their fingertips.

Agentic AI stands apart from traditional AI agents by enabling proactive, goal-driven workflows. Think of it as a team of intelligent agents that autonomously plan, delegate, and execute complex tasks across multiple phases. Unlike generative AI, which passively responds to prompts, agentic systems assess objectives, break them into subtasks, coordinate across tools or agents, and adapt dynamically with persistent memory and automated orchestration.

Brownloop’s Kairos exemplifies this model in the private equity domain. Its specialized agents collaborate through a central “Control Tower” to handle discrete but connected tasks like deal sourcing, diligence, portfolio monitoring, LP reporting, and more, routing responsibilities intelligently based on context. For example, one agent extracts data from a CIM, another scores diligence risk, while a third auto-drafts an investment memo and all operate in concert to achieve seamless transaction workflows.

This agentic approach drastically improves efficiency and decision quality. As research shows, multi-agent AI systems boost autonomy while raising new challenges around trust, coordination, and explainability. Kairos tackles these challenges via private deployment, explainable outputs (“maker-checker” workflows), and robust enterprise-grade controls, holding agents accountable and human oversight intact.

Intelligent agents working in harmony to execute end-to-end investment tasks under a central control mechanism.

Decomposing workflows such as sourcing → diligence → memo drafting, with each sub-agent focusing on its specialty.

clear audit trails, private deployments, and human-in-the-loop checks ensure trust, control, and regulatory compliance.

Kairos is engineered to seamlessly blend with both structured and unstructured data sources, enabling Private Equity teams to tap into every corner of their investment ecosystem—from CRMs (Salesforce, HubSpot etc), financial systems (NetSuite, QuickBooks), data rooms (Intralinks, Datasite), ERP platforms (SAP, Oracle etc), to spreadsheets, PDFs, market data providers (PitchBook, Capital IQ etc), and even internal file drives and email archives, all without the need to manually consolidate information.

By providing deep connectors into enterprise systems, third-party data feeds, and file repositories, Kairos supports real-time ingestion and harmonization of financials, contracts, CIMs, operational KPIs, and market indicators. Its robust data integration layer cleanly matches and verifies data points across sources, reducing manual data wrangling and ensuring consistency across the entire deal lifecycle.

Once ingested, the data flows through a centralized knowledge graph and agent-control tower, enabling context-aware routing between Deal Execution, Portfolio Optimization, Investor Relations, and Risk agents. The result is an end-to-end, secure, and explainable integration architecture, fully deployed within the client’s infrastructure empowering PE teams to generate IC memos, dashboards, portfolio insights, LP reports and more effortlessly.

Kairos excels at transforming unstructured deal documents such as CIMs, teasers, contracts, and data-room files into structured, actionable intelligence. Through its Document Generation & Summarization feature, the platform automatically extracts key highlights, financials, and red-flag items, harmonizing data from a mix of Excel spreadsheets, PDFs, slides, and transcripts. Complex financial details like revenue trends, margin shifts, and contractual triggers are chronologically organized and parsed for review, enabling teams to quickly identify critical issues without manual sifting.

Beneath this functionality lies Kairos’s agent-driven AI pipeline part of the “AI-based data harmonization and standardization” core which combines generative and agentic models to dissect and integrate documents seamlessly. Specialized “Document Intelligence” agents flag compliance risks in contracts, track renewal clauses and obligations, and score diligence areas across files. Kairos ensures a cohesive, human-in-the-loop review process with full traceability and approval workflows in place.

The document analyser acts as a force multiplier for due diligence and portfolio management automating extraction, detection, summarization, and tracking across every stage. It not only surfaces insights faster but does so within an auditable, secure environment tailored to private equity needs.

Empowering private equity firms to achieve their full potential through Empowering private equity firms to achieve their full potential through

Empowering private equity firms to achieve their full potential through Empowering private equity firms to achieve their full potential through

Empowering private equity firms to achieve their full potential through Empowering private equity firms to achieve their full potential through