Transform Investor Relations From Periodic Reporting to a Strategic Partnership

Elevate every LP interaction with continuous intelligence, embedded AI solutions for investor relations, and institutional memory that builds trust, transparency, and long-term alignment.

Kairos IR Suite: Build Strategic, Data-Driven Partnerships

Kairos enables investor relations teams with an AI-native intelligence platform that builds institutional memory across every LP interaction, preference, and strategic priority. It delivers automated investor briefings, predictive engagement intelligence, and compound knowledge that strengthens with every conversation, helping IR teams to evolve from administrative execution to strategic relationship orchestration.

Key Kairos Agents for Investor Relations Teams

AI-powered assistants designed to simplify IR operations, enhance LP transparency, and compound institutional knowledge over time.

LP Briefing Generator

DDQ Response Builder

Quarterly Letter Composer

LP Intelligence Dashboard

Co-Investment Matcher

LPAC Material Builder

Fund Agreement Intelligence

Commitment Capacity Predictor

End-to-End IR Workflows

Kairos unifies investor onboarding, reporting, communication, and compliance into a single intelligent workspace. Every LP interaction, update, and obligation is connected through real-time intelligence, creating seamless, transparent, and proactive engagement across the entire investor lifecycle.

Smarter DDQ Response Management

Custom Workflows: Align DDQ stages with your internal processes for tailored response management.

Built-in Compliance Checks: AI flags regulatory risks and ensures standards are met automatically.

Central Knowledge Base: Store FAQs and past responses for consistent, efficient reuse.

Stale Response Alerts: Identify outdated inputs needing review before submission.

Centralized DDQ Knowledge Engine

Quick Data Import: Seamlessly ingest existing DDQs and FAQs to build your knowledge base.

Smart Suggestions: AI recommends best-fit answers based on context and past responses.

Advanced Search Tools: Instantly locate relevant content with robust filtering and full-text search.

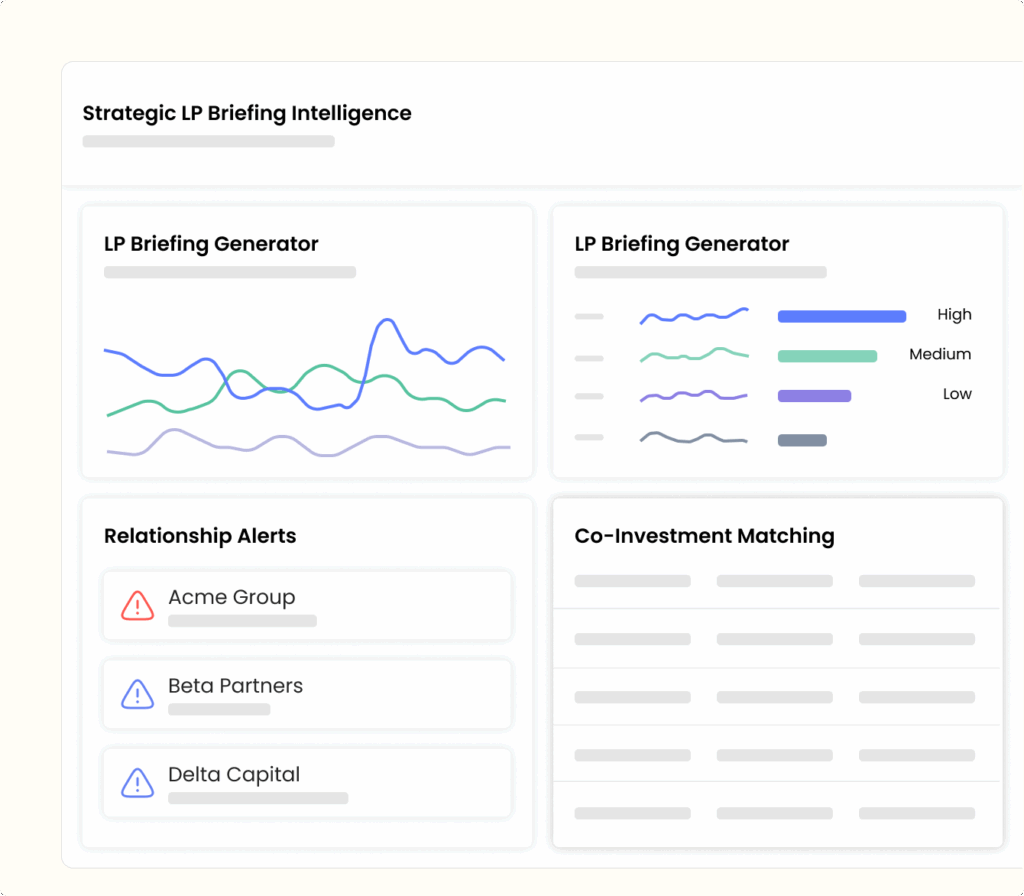

Real-Time LP Engagement Visibility

Predict re-engagement timing and monitor relationship health across your LP base.

Engagement Scoring: Track LP touchpoints, responsiveness, and warmth trends.

Commitment Predictor: Anticipate readiness based on fund cycles and historical signals.

Relationship Alerts: Proactive nudges when engagement drops or momentum builds.

Co-Investment Matching: Surface LPs aligned to opportunity based on mandates and interest history.

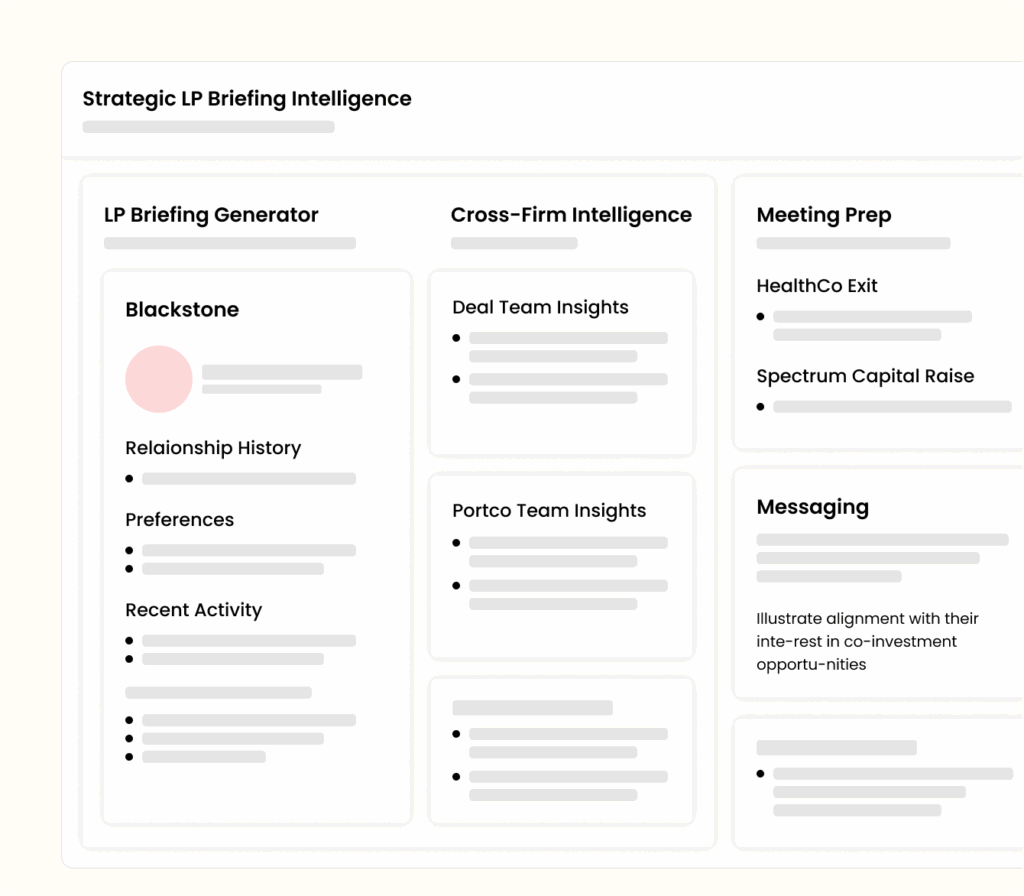

Strategic LP Briefing Intelligence

LP Briefing Generator: Auto-compiles full relationship history, preferences, and recent touchpoints.

Cross-Firm Intelligence: Pulls from deal, portco, and finance teams for a 360° LP view.

Meeting Prep in Minutes: No manual research—actionable insights are delivered instantly.

Tailored Messaging: Aligns value stories with each LP’s mandate, history, and decision logic.

The Kairos IR Suite Differentiator

Transform fragmented investor communication into a living intelligence ecosystem with AI solutions for investor relations teams. Kairos allows your IR teams to move from static reporting and reactive execution to continuous intelligence and strategic engagement.

Without Kairos

- Fragmented systems and manual workflows slow reporting cycles.

- LP data is scattered across CRMs, emails, and spreadsheets.

- Relationship context is lost when team members transition.

- Responses are reactive, inconsistent, and prone to human error.

- Insights trapped in documents, with no cumulative learning over time.

- Institutional knowledge resets with every fund cycle or team change.

With Kairos IR Suite

- Unified intelligence layer connecting investors, funds, and portfolios.

- Institutional memory that compounds with every LP interaction.

- AI agents automate DDQs, reports, and investor briefings.

- Consistent, compliant communication powered by real-time data.

- Predictive insights that elevate engagement and build LP trust.

- Knowledge compounds across fund cycles, ensuring context never gets lost.

Integrate Your Ecosystem Seamlessly

Tailored to Your Investor Relations Team’s Workflows

Purpose-built to power precision, context, and confidence in every LP interaction.

Kairos combines PE-native intelligence with deep consulting expertise to empower your Investor Relations functions, from data unification and reporting automation to strategic communication and engagement design.

Explore Our Latest Publications

Revolutionizing Investment Committee Visibility with Kairos by Brownloop

A global private equity firm with over $100 billion in assets under management (AUM) faced growing challenges in managing its Investment Committee (IC) processes.

Accelerating DDQ Responses by 78% for a Global Mid-Market Firm

Brownloop’s consulting standardized siloed workflows and data, enabling AI to cut DDQ response time by 78% and accelerate fundraising.

Revolutionizing Private Equity Deals Through CIM Automation

How a Top Private Equity Firm Advanced its Investment Process with Automation and AI

In the competitive private equity landscape, speed and precision are paramount. Manual Investment Committee (IC) memo preparation can be slow, inconsistent, and a significant bottleneck to high-value opportunities.

Enterprise-Grade Security and Compliance

Kairos’s AI solutions for investor relations teams are designed for the rigorous security and compliance standards of private equity. Every layer ensures your confidential information remains protected, compliant, and auditable, without compromising agility or collaboration.

SOC2 I

SOC2 II

Encrypted in transit

and at rest

No training on

user data

Fast to Deploy and Built to Scale

Kairos delivers rapid, low-friction AI solutions for investor relations teams, delivering measurable ROI in weeks. Our structured rollout ensures seamless integration, immediate efficiency gains, and scalable intelligence that strengthens your Investor Relations function with every interaction.

Discovery & Pilot

Connect fund admin, CRM, and LP reporting data; deploy core IR agents for instant automation and harmonized reporting.

Expansion & Optimization

Automate LP communication workflows and real-time dashboards, reducing reporting cycles by up to 40% with near-zero discrepancies.

Institutionalization

Integrate Kairos across portfolio, finance, and deal teams—building compound intelligence and cross-functional visibility that strengthens firm-wide collaboration.

Time to ROI

Most firms see tangible efficiency and trust gains within 60 days, achieving full institutional value in under a quarter.

Make the Shift from Managing Data to Mastering Relationships

Unify your LP data, automate engagement, and deliver precision-driven insights with Kairos’ IR Suite.